- OddsDigger

- Blog

- How to Calculate The Kelly Criterion: Fractional Kelly Staking Calculator

How to Calculate The Kelly Criterion: Fractional Kelly Staking Calculator

Our partners: 777Spinslot is a reliable gaming platform that constantly upgrades its assortment of games to get better results and to bring users the newest free slot no deposit to work with.

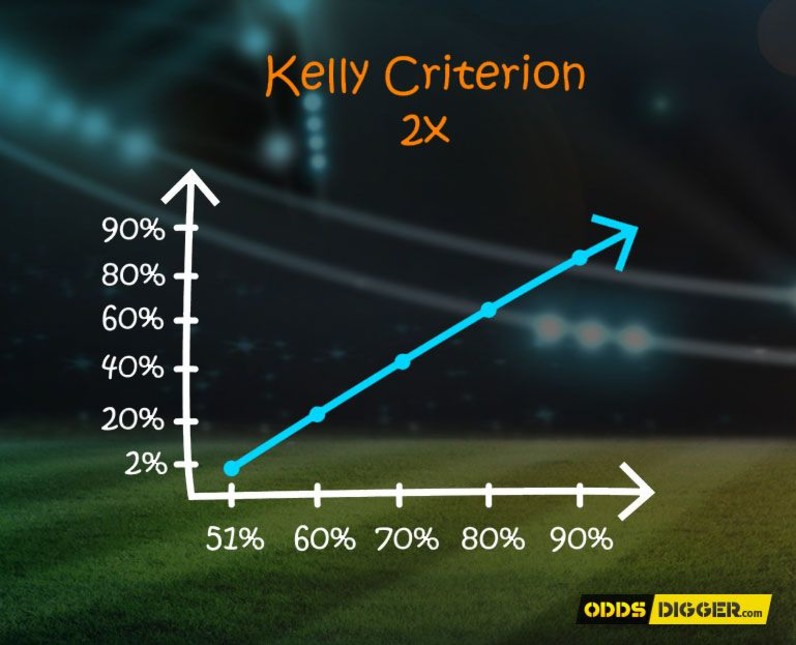

The Kelly criterion is a strategy that is designed to balance the risk and reward for a gambler. It works on the principle of sizing the bet appropriately so as to arrive at a better conclusion. One of the key elements that is required in the world of gambling and betting is the better management of funds. Many gamblers often end up losing money largely because they do not have a plan when it comes to sizing the bet. The Kelly staking strategy is seen as an important criterion in the world of finding value in a bet. Several strategies are available to find value and the Kelly criterion often ranks at the top.

What Are The Issues With The Kelly Criterion?

Just like every other betting strategy, it should be remembered that Kelly criterion is not 100% accurate. The system was invented by John Larry Kelly, who claimed that this strategy is primarily intended to work in a situation where the gamble is being done over and over again, with a similar payout ratio and the probability of success or failure. The Kelly criterion has several issues when it comes to the world of sports betting, as it is almost impossible to find identical events. Each event will come with its own set of challenges and outcomes. For the Kelly betting system to succeed, the punter will need a value opportunity and a positive edge.

Even if the punter has a value bet, they stand to lose quite a lot of money if each bet is 100% of their funds. It is important to size the bet so that the chance of going bust reduces.

How To Calculate The Kelly Criterion?

The key requirement of the Kelly criterion is to balance the two extremes of risk and reward. The first element that needs to be balanced is the size of the bet, and the second factor that will be controlled by this system is the size of the edge. Punters should always be aware that the stake should be a sign of the value provided by the opportunity. Let us consider the example of a situation where the punter stands at a 53% probability of success and the price provided is 3.00. Now, the punters should only come in with a bet edge of 6% (53%-47%) with 47% being the probability of a loss.

Punters with a smaller edge, for example, of 52% probability of success and odds of 3.00 should go with a stake of 4% (52%-48%).

What's The Kelly Staking Formula?

Kelly criterion is all about the process of coming up with the betting size that manages to balance the risk and reward. The Kelly criterion formula is:

(bp-q)/b

Here:

- b is the decimal odds of an event -1

- p is the probability of success

- q is the probability of failure (which can be calculated by 1-p)

Fractional Kelly Staking Calculator

One of the disadvantages of the Kelly strategy is that the punter may overestimate the edge, and this could turn out to be a serious mistake. This is especially in the case of sports events, as it is difficult to predict the outcome in a precise manner. In order to avoid losing out on a great bet, punters have been using the fractional Kelly system. This is a slightly more cautious approach of the Kelly system which does take into consideration some of the risks involved. The fractional Kelly system is all about using the fraction rather than a suggested percentage of a bet. It is possible to calculate the fractional Kelly system using the following step:

((Probability × odds)-1)/((odds-1) × (chosen fraction multiplier))

Hence, the defining factor in this formula happens to be the fraction that the punter chooses for the particular event.

Let us assume the case of a punter who decides to go with a 1% fraction. In this case, if the punter has funds of $1000 then the recommended stake would be $10. The punter is free to choose any fraction that they wish to apply. Even in the above example, if the punter opts for a 20% Kelly betting strategy, then the stake would be $200 and so on. The basics of this system is that it is a conservative method that helps spread out the bets and take advantage of the diversification. The punter will have significant funds available for other betting opportunities and this significantly lowers the risk.

The process of avoiding losses in the long run is one of the key requirements for the punter who wants to make money. Even though this system may not reward a huge deal straight away, it is possible to see the bankroll slowly increasing over a period of time.

Kelly Criterion Excel Spreadsheet

Excel is an extremely powerful program that can be used for various betting related situations and none more so than calculating the Kelly criterion. It is possible to come up with Excel spreadsheets that do all the calculations in order to find out if a potential bet is viable under the Kelly criterion strategy. A punter simply needs to enter the various odds and probability numbers in order to come up with the figures.

Kelly Staking Football Excel Spreadsheet

Football can be a difficult sport to predict due to the presence of various factors that play a role in the outcome of an event. Yet, one can apply Kelly staking strategy even in terms of football and this can be calculated quickly using the Excel spreadsheets. This spreadsheet is specifically for the 1X2 football markets and punters need to enter the details like odds, probability, bankroll, and the desired Kelly fraction in order to come up with the potential bet sizes that would help the punter minimise the losses and maximise the returns each weekend.

How To Make Your Own Kelly Calculator In Excel?

One of the best ways to take advantage of the system is to create a spreadsheet in Excel so that punters can quickly calculate the Kelly criterion numbers for a specific event. Creating the spreadsheet in Excel takes no more than a couple of minutes. The various headers that need to be created within the Excel sheet are:

- Betting Bankroll

- Kelly Fraction

- First Outcome

- Second Outcome

- First Odds

- Second Odds,

- First Probability

- Second Probability

- First Kelly stake

- Second Kelly Stake

These headers will define the Kelly criterion calculator using the Excel spreadsheets.

The user can enter the bankroll and the desired Kelly fraction under the first two headers. The first outcome and second outcome events are also filled in appropriately. Now, the first probability corresponding to the first outcome and the second probability corresponding to the second outcome are also filled under the respective headers. Now, the punter has to provide an estimated probability of each outcome coming out successful. Finally, Excel is given the task of calculating the big numbers by using the following formula:

((((first outcome odds × first probability)-1)/(first outcome odds-1)) × bankroll) × (preferred Kelly fraction)

This formula needs to be applied within the Excel sheet and it is to be repeated for the second Kelly stake. Now, merely entering the outcome, odds, and the probability of occurrence will provide a Kelly stake number. It is recommended to try out a criterion example before using the spreadsheet for actual betting purposes.

What Are The Benefits Of Using Kelly Staking?

The primary reason for using the Kelly calculator is to determine an ideal stake that would limit the losses while also balancing the rewards. Admittedly, the rewards may not be huge as in the case of a punter going in with the entire bankroll, but the risk to reward ratio is much better while using the Kelly criterion. Even though betting may be a favourite pastime for many, it happens to be a serious business for experienced to punters.

It has been seen over the years that punters who decide to use the full Kelly system are at a 33% risk for the bankroll to reduce before they can start building the rewards. However, it is surprising to find out that the conservative approach provided by the fraction Kelly or half Kelly is significantly beneficial at reducing the losses in a bankroll. The half Kelly system will only eat away 11% of the bankroll before it is doubled.

Conclusion

Since the Kelly criterion works on the principle of taking the bankroll into account, it manages to reduce the losses quite significantly. Other betting strategies employed by punters are also quite effective at helping them succeed, but it is the Kelly criterion that helps the punter avoid losses using the technique of bet sizing. Moreover, the system is also the fundamental aspect of bankroll management. Since most of the top betting strategies do not have a specific plan in order to arrive at stake, it is imperative for punters to use the Kelly formula to find value and have a bankroll that is not at a greater risk.